Spotalpha.com provides AI powered quantitative market research and analysis tools for US and Indian markets. It optimizes your portfolio, identifies trends, sends rebalance alerts, helps you find the right investment strategy for your risk profile, keeps you posted on breaking news and does a lot more.

Markets are volatile and unpredictable. Risks to your investments are constantly changing. Sometimes risk is stock specific and other times it can be much broader (macro-level) event. This is where Spotalphas research and tools come in handy. They provide you with 100% algorithm generated rational research - not biased by human emotions such as fear or greed.

Spotalphas approach is not new. Quantitative finance has been around for more than three decades and is widely used by fund managers and investment bankers. However, these tools have typically been expensive (costing several thousand dollars a month as subscription fees). Spotalpha can provide these same tools at a significantly lower price because of automation and by leveraging the latest advances in maths and computation.

Spotalphas algorithms screen more than 100,000 instruments globally every day. This helps it to identify whats changing in the market and generate easy to use actionable research. Each one of Spotalphas research reports has outperformed the benchmark index consistently over the last 5 years - even during the most volatile market conditions.

FEATURES OF THE APP

- SIGNALS: Get free access to one trend signal every hour. These high-performance and easy to use trend signals are part of our Alpha Builder tools for self-directed investors.

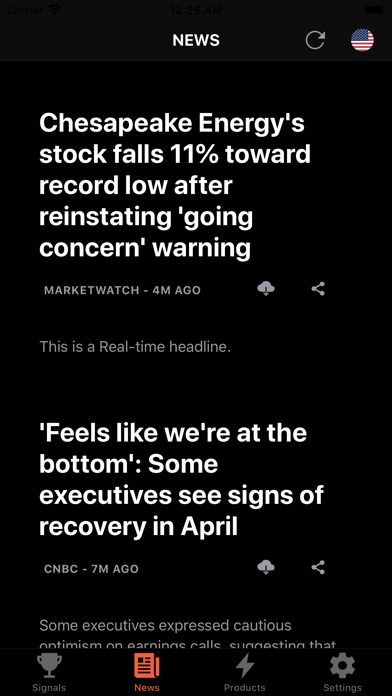

- NEWS: Be the first to read breaking news impacting capital markets. Our news feed is aggregated from more than 15 leading publishers.

- PRODUCTS: Access the complete range of Spotalpha.coms research reports and tools, directly from the app. This includes:

(1) Alpha Portfolios (Research report) are dynamically re-balanced, rule-based portfolios built with the goal of outperforming the benchmark. There are three Alpha portfolios (Large cap, Mid cap and Small cap) which typically have between 5 to 15 stocks. Each alpha portfolio is rebalanced between 3 to 8 times a year.

(2) Alpha Trends (Research report) screens the most liquid large and mid cap stocks to identify up to 5 bullish trend signals.

(3) Alpha Ratings (Research report) ranks and rates all listed instruments on a risk adjusted return basis. These ratings are updated every month and are ideal for buy and hold investors.

(4) Alpha Funds (Research report) ranks and rates all registered mutual funds, fund managers and fund houses. We provide current and future ratings that are updated every day and are ideal for mutual funds investors.

(5) Alpha Builder (Tools) is a suite of 19 research tools that helps you perform great market research. These tools have a live and proven track record of generating alpha (outperformance). They are also used internally within Spotalpha for all our research products (Alpha portfolios, Alpha ratings, Alpha trends, ...).

(6) Portfolio Optimizer - Stocks and Mutual funds (Tools) are two separate tools that help you build efficient portfolios that deliver more return for the risk you are willing to take. They deliver high performance by improving selection and allocation efficiency of your stocks and mutual funds portfolios.

RECOGNITION

Spotalpha.com is recognized by Gartner as GARTNER Cool Vendor 2019 in the category of AI for Investment Services.

https://www.gartner.com/en/documents/3909052/cool-vendors-in-ai-for-banking-and-investment-services

Visit us at:

https://spotalpha.com/

Join thousands of investors using Spotalpha.com every day to make safe investment decisions.